Buy Travel Insurance Online Starting AED 80 Only

What is Travel Insurance?

Travelling is one of those things we all look forward to, no matter where we plan to take off. From sandy beaches and snow-covered mountains to the hilly greens and bustling cities; the world is our platter and the very act of traveling- our chance to experience at least one portion of it.

Comprehensive Travel insurance covers cost, losses, and other predefined expenses associated with travelling. It protects the policy holders from different types of losses they might face during their travel.

It covers a range of services like baggage/passport loss, flight delays, flight cancellations, medical expenses, etc. Your travel insurance is a document that acts as a safety net every time you travel.

eSanad’s Travel Insurance is designed to accompany you on all your travels; to help you travel smarter and safer.

From unpredictable flight delays and missed connections to loss of belongings, medical emergencies, and adventure sport ouches, we cover for you so that nothing takes away your peace of mind.

After all, traveling is meant to help you rejuvenate and relax and our comprehensive travel insurance policy online is customized to ensure you can experience just that. The flexibility of our policy allows us to cater to your needs.

So, whether you accidentally hurt yourself while bungee jumping, get scammed only to lose out on your wallet and passport or get into a legal issue for damaging your car rental abroad; you’re securing your trip with an overseas travel insurance will ensure you’ll be covered through it all.

The best part? You need not go through long and cumbersome processes to get your compensation or claims settled. Everything from buying travel insurance online to making a claim is super simple and can be done online, within minutes!

Do I Really Need Travel Insurance?

If that’s a question you’ve been battling with, read on.

28 million baggage are reportedly mislaid by airlines every year.

1 in 4 passengers have lost their checked-in baggage in the last 3 years.

47% of baggage loss happens during international traveling.

Phones, Bank Cards, Licenses, Jewellery, Electronic Gadgets & Passports are the commonly lost belongings while travelling.

There are roughly 20,000 delayed and cancelled flights every day.

Trip cancellation, flight cancellations and delays have always been leading causes for travel claims.

Travel scams are extremely common in tourist-heavy countries.

Check Benefits of eSanad’s On The Move Policy

What’s Great About International Travel Insurance by Digit?

- Zero Deductibles – You don’t pay anything at all when you make a claim – it’s all from us.

- Adventure Sports Covered – Our adventure sports coverage includes activities such as scuba diving, bungee jumping & sky diving.

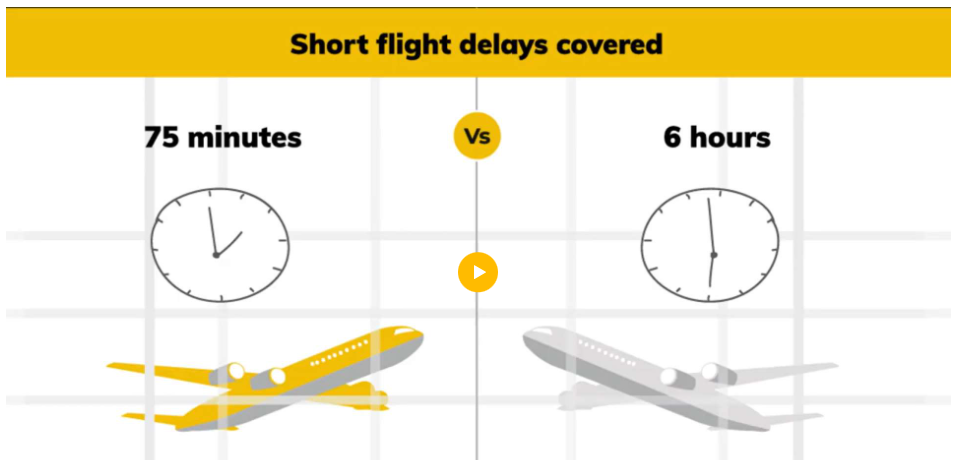

- Immediate Monetary Compensation for Flight Delays – We don’t want to waste your time any further. That’s why, when your flight is delayed for more than 6 hours, we give you immediate compensation.

- Smartphone-enabled Processes – No paperwork, no running around. Just upload your documents when you make a claim.

- Missed-call Facility – Give us a missed call on our toll-free number 02 610 9000 and we’ll call you back in 10 minutes. No more international calling charges!

- Worldwide Support – We’ve partnered with the world’s largest health & travel insurance network, Allianz Global Assistance, to support you seamlessly across the globe. T&C*

Travel Insurance Plans that Fit Your Needs

Basic Option

Offers coverage for the most common mishaps that can be encountered on an international trip.

Comfort Option

This plan not only covers you for the most common mishaps on your trip but also keeps you protected from each hiccup, so your trip goes just how it should!

Some of the Basic Coverage under Travel Insurance by eSanad

Medical Cover

- Emergency Accidental Treatment & Evacuation: Accidents occur at the most unexpected times. Unfortunately, we can’t save you there, but we can surely help you get the best treatment. We cover you for immediate medical treatment that results in hospitalization.

- Emergency Medical Treatment & Evacuation: God forbid if you fall ill during your trip in an unknown country, don’t panic! We will take care of your treatment costs. We will cover you for expenses like hospital room rent, operation theatre charges, etc.

- Personal Accident: We hope this cover is never required. But for any accident during the trip, resulting in death or a disability, this benefit is there for support.

- Daily Cash Allowance (Per day): We hope this cover is never required. But for any accident during the trip, resulting in death or a disability, this benefit is there for support.

- Accidental Death & Disability (Common Carrier): While this cover has everything like the emergency accidental treatment cover, it has one extra layer of protection. It also covers death & disability while boarding, de-boarding or are inside the flight (Touchwood!).

- Emergency Dental Treatment: If you encounter acute pain or meet with an accidental injury to your teeth on the trip, resulting in emergency dental treatment provided by a medical practitioner, we will cover you for the expenses incurred due to the treatment.

Smooth transit Covers

- Trip Cancellation: If unfortunately, your trip gets cancelled, we cover the pre-booked, non-refundable expenses of your trip.

- Common Carrier Delay: If your flight gets delayed by more than a certain time limit, you get the benefit amount, no questions asked!

- Delay of Checked-in Baggage: Waiting at the conveyor belt is annoying, we know! So, if your checked-in baggage is delayed for more than 6 hours, you get the benefit amount, no questions asked!

- Total loss of Checked-in Baggage: The last thing that can happen on a trip is your baggage getting lost. But if something like this happens, you get the benefit amount for the entire baggage getting permanently lost. If two out three bags are lost, you get a proportional benefit, i.e., 2/3rd of the benefit amount.

- Missed Connection: The last thing that can happen on a trip is your baggage getting lost. But if something like this happens, you get the benefit amount for the entire baggage getting permanently lost. If two out three bags are lost, you get a proportional benefit, i.e., 2/3rd of the benefit amount.

Flexible Trip

- Loss of Passport: The worst thing to happen in an unknown land is to lose your passport or visa. If something like this happens, we reimburse the expenses, if it is lost, stolen or damaged while you are outside of your country.

- Emergency Cash: If on a bad day, all your money is stolen, and you need emergency cash, this cover will come to your rescue.

- Emergency Trip Extension: We don’t want our vacations to end. But we don’t want to stay in a hospital too! If due to an emergency during your trip, you need to lengthen your stay, we will reimburse the cost of hotel extensions and return flight rescheduling. The emergency could be a natural calamity in your travel area or an emergency hospitalization.

- Trip Abandonment: In case of emergency, if you had to return home early from your trip, that would be sad. We can’t fix that, but we will cover charges for alternate travel arrangements and non-refundable travel costs like accommodation, planned events and excursion expenses.

- Personal Liability & Bail Bond: Due to an unfortunate incident, if there are any legal charges against you while you are travelling, we will pay for it.

The coverage options suggested above are only indicative and are based on market study and experience. You may opt for any additional coverage as per your requirement. Please call us on 02 610 9000 if you want to opt for any other coverage or wish to know further details.

What’s Not Covered?

While ours is a comprehensive travel insurance that covers most things that could go wrong on vacation, we are completely open to all that we do. Understanding what your travel insurance does not cover is just as critical as knowing what is covered. The following are some exclusions that our travel insurance will not cover:

- We can’t cover diseases or illnesses that have already been diagnosed, or if your doctor has already recommended no travelling.

- Death or disability won’t be covered after 365 days of the accident that has caused it.

- Adventure sports are covered if you’re doing it for the duration of one day. This doesn’t include weeklong treks, hikes or professional level adventure sports that go on for more than one day.

- Flight delays aren’t covered if your airline already informed you about the same at least 6 hours in advance.

- Delay of checked in luggage is not covered if the delay is due to customs.

- Any missed connection where the time gap between scheduled arrival of incoming flight and scheduled departure of connecting flight was less than the time required.

- Thefts aren’t covered if you only make the required police complaint after getting back from your trip.

- Thefts won’t be covered if the police of the respective aren’t notified within 24 hours.

- Trip extensions due to childbirth or related matters can’t be covered.

- Trip abandonments due to pre-existing illnesses or health conditions can’t be covered.

- Trip cancellations due to rejection of visa is not covered.

Know Your Insurance Policy

It’s important to thoroughly go through your policy document to be educated about your insurance policy. After all, you bought this policy to secure yourself during uncertain times. eSanad is all about simplifying insurance so much that even a 5-year-old understands complicated terms!

Since our travel insurance policy is a comprehensive one, we’ve simplified few difficult terms that are mentioned in your policy document below:

- Disclosure to Information Norm: In the event of misrepresentation, misdescription or non-disclosure of any necessary facts, your policy will become void/invalid, and all the premium paid will be forfeited to the company.

- Cashless Facility: Cashless facility is a convenient mode of payment for your medical treatment costs, where the pre-authorized payments are done directly to the network provider/hospital/ASP by your insurer.

- Medically Necessary Treatment: Medically necessary treatment is any treatment, tests, medications, or hospital stays that is required for the management, care or treatment of any illness/injury sustained by the insured (you).

- Free Look Period: This is a specific set of days (15 days from the date of receipt of the first policy document) where you can review the terms and conditions of your policy and decide if you want to cancel or continue with your policy. The Free Look Period is not applicable for renewed policies and policies with policy period of less than one year.

- Common Carrier Delay: A common carrier refers to any commercial, public airline, train, motor transport, or water-borne vessel operating for transport passengers and/or cargo. Your insurance policy offers compensation in case of common carrier delay. For example, if you must catch your scheduled flight but learn that it is delayed by 3 hours, then you can file a claim under common carrier delay cover provided the time excess stated in the policy schedule is less than 3 hours. This amount is specified in your policy subject to certain terms and conditions such as delays due to weather, strikes, equipment failure, etc.

- (Waiver) of Pre-Existing Diseases: Pre-existing diseases are those illnesses or ailments you have before you start a new health plan (in this case, a comprehensive travel plan). Diabetes, cancer, asthma, high blood pressure, etc., could be examples of pre-existing diseases (PED). A waiver of PED means that your insurance policy will cover you for emergency treatment related to your pre-existing diseases if you opt for the PED Cover.

- Personal Liability and Bail Bond: Personal liability refers to property or bodily damage or injuries to a third-party, accidentally, where you are held legally responsible. Bail Bond is a document stating that a specific amount has been paid to allow a person accused of a crime to remain free until trial. It is a surety bond (money or property) offered or deposited by a defendant to be released from custody. If you’ve travelled abroad and find yourself in something of a pickle and are wondering how to handle legal issues when in a foreign country, then these covers offer benefits that protect you from heavy debts in case of lawsuits.

- Financial Emergency Cash: If you’ve ever found yourself in a foreign country and your wallet is stolen, you might be short on cash or lose all financial sources. In such cases, your insurance company can provide you with cash in emergency situations. Getting travel insurance that provides financial emergency cash is a smart choice because you never know when petty crimes like pickpocketing and thefts could occur to you.

Understanding our policy document is important, that’s why we’ve also simplified some of our coverages to help you get a better understanding of them.

Types of Travel Insurance

When travelling, you need to have an insurance plan in hand. You’ve already read why it’s important to secure yourself, now you’re wondering which plan do I pick? There are different kinds of plans available depending on the purpose, duration, and nature of your trip. Before selecting your plan, you should also keep the coverage and premium offers in mind.

Some types of travel insurance are:

- Individual Travel Insurance: An Individual travel insurance plan is suitable for those on a solo trip. Keeping in mind multiple things that can go wrong, it is important to be cautious, especially on your own.

- Corporate Travel Insurance: The Corporate travel insurance plan is offered to an employee who is travelling on a business trip. This plan is purchased by the firm or employer, to secure the safe travels of the employee.

- Student Travel Insurance: If you’re a student wanting to go abroad on an educational basis, then this plan is for you. Designed keeping the needs of a student in mind, this plan offers beneficial covers at minimum expense.

- Group Travel Insurance: This plan benefits the whole group of travelers for unforeseen expenses or losses incurred during the trip. A significant advantage of this plan is reduced costs compared to individual plans for each traveler.

- Family Travel Insurance: Covering the immediate family members of the policy holder under a single plan, this type of international family travel insurance is designed for families that travel together.

- Senior Citizen Travel Insurance: Travelling above the age of 70 trails its own risks alone. That’s why having insurance in hand saves you from unexpected issues like medical expenses, unpredictable financial emergencies, etc.

- Domestic Travel Insurance: Domestic travel insurance comes in handy when you are travelling within national boundaries.

- International Travel Insurance: Similarly, international travel insurance is useful for international travel. In many countries, it is mandatory to have travel insurance with you while applying for your visa. This protects you from unforeseen expenditure.

- Schengen Travel Insurance: A Schengen travel insurance is one that is applicable when travelling to the 26 Schengen countries. This plan secures you from financial losses. You can also avail yourself of many benefits as defined by the policy you opt for.

- Annual or Multi-trip Travel Insurance: An annual or multi-trip plan is suitable for year-round trips mostly undertaken by those in the corporate sector. If you travel often or more than once a year, then this plan is suitable for you.

- Single trip Travel Insurance: A single trip travel plan fits those who travel abroad occasionally.

Is Travel Insurance Mandatory for Travel?

No, travel insurance isn’t mandatory for all countries internationally. However, it is recommended to get one as it not only protects you against unfortunate situations in a foreign land but also strengthens your visa application in many situations.

It is compulsory in several countries, including ones in the Schengen region. Without one, you may not get an approved visa of the respective country.

Check out the list of countries where Travel Insurance is mandatory:

- Cuba

- United States of America

- Schengen Countries. It is a group of 26 countries in Central Europe.

- Ecuador which includes the Galapagos Islands.

- Antarctica

- Qatar

- Russia

- Turkey

- New Zealand

- Nepal

- Morocco

Precautions to Remember Before Traveling

- Avoid taking your passport everywhere. It’s better to instead leave it in your hotel locker and instead carry a copy of the same for your ID purposes.

- Don’t carry too much cash around and while withdrawing cash from the ATM, always check your surroundings and check your notes too after your money is withdrawn.

- Don’t fall for petty travel scams such as fake monks asking for donations, overcharging cab drivers, fake tour guides, etc. To learn more about travel scams in different places and how you can stay safe from such situations, check out our in-house Couch Potato.

- Always keep your cash in more than one place. For example, you can carry some cash in your wallet, while some of it can safely be kept in an inside pocket of your backpack.

- Remember the location of your accommodation well and always use cabs that go by meter or else you’re likely to be scammed by them!

Last modified: January 17, 2024